Introduction :

This article lists the steps to get an soft copy of the HDFC Bank deposit slip. You can get two versions of the deposit slip, either (a) pre-filled, OR (b) blank HDFC Bank account deposit slip ..

Before you start to download the Bank Deposit Slip

We assume the following:

- You have a bank account with HDFC Bank

- You have net banking facility activated for the HDFC Bank bank account in question.

Step-by-step guide to generate and download the HDFC Bank Deposit Slip

Time needed: 15 minutes

Step-by-step guide to generate either (a) pre-filled , or (b) blank deposit slip ..

- Login to the HDFC Bank Netbanking portal

a. Go to the https://netbanking.hdfcbank.com/netbanking/.

b. Login with the User ID/Customer ID, IPIN/Password, and Secure Access Image/ Message. - Navigate to the appropriate tab under the “Request” section under “Accounts”

a. Under “Accounts”, click on “Request” to expand the option, and choose the “Download Deposit Slip” option..

- Choose the type of the Deposit Slip needed

a. Choose the type of deposit slip needed. viz. whether (i) Blank Deposit Slip, or (ii) Pre-printed Deposit Slip/Pre-filled Deposit Slip

b. If you desire Pre-printed Deposit Slip, then you can choose the bank account number from the drop down list in the “Select an account” option. - Accept the terms and conditions.

a. Here, click the checkbox, indicating that you accept the terms and conditions.

- Click “Download”

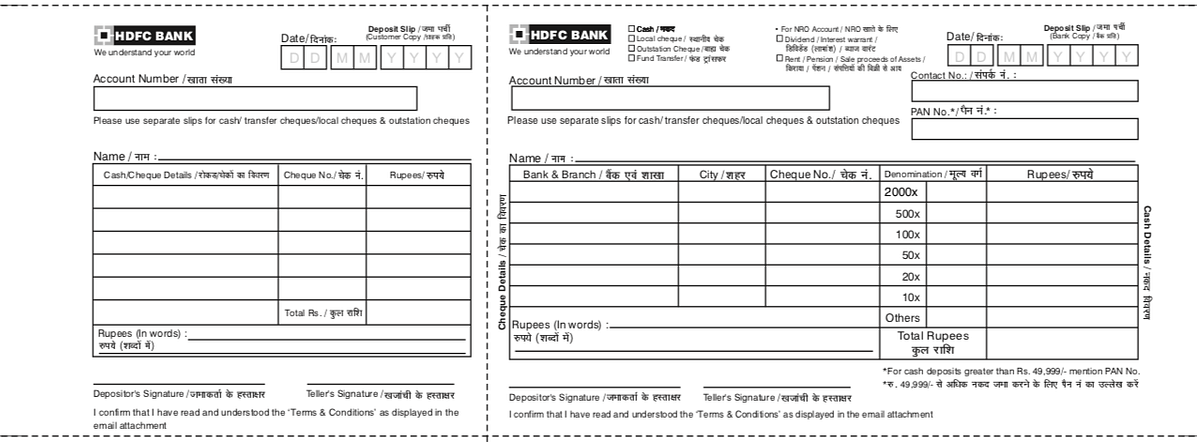

Next, click “Download” to download a PDF copy of the deposit slip, that may be printed, and used, while performing the in-person transactions at the HDFC Bank branch.

Sample of the same is below

- Done!

You now have a PDF copy of the deposit slip, Feel free to print multiple copies, and/or take photocopies of the same to use in the branch for in-branch transactions.

Conclusion.

So, that is it. These are all the steps you need to generate the deposit slip, that can be used for all your in-branch physical transactions at the Bank.. You may printout a copy, and then use photocopies to use at the branch, whenever you next visit for in-branch transactions. Now, there is no frantic search for the slips, when you step into the branch. You may fill in the slips in the convenience of your home, and visit the branch for the transaction only.

Check out other how-to guides, and info-wiki articles on webnotes.in.